Loan Application is a document which contains the information regarding the Loan Applicant, Loan Type, Repayment Method, Loan Amount and Rate of Interest.

📌Prerequisites

Before creating a Loan record, it is necessary that you create the following documents:

👉🏻 To access Loan Application, go to:

HR> Loan > Loan Application

⚙ Steps:

-

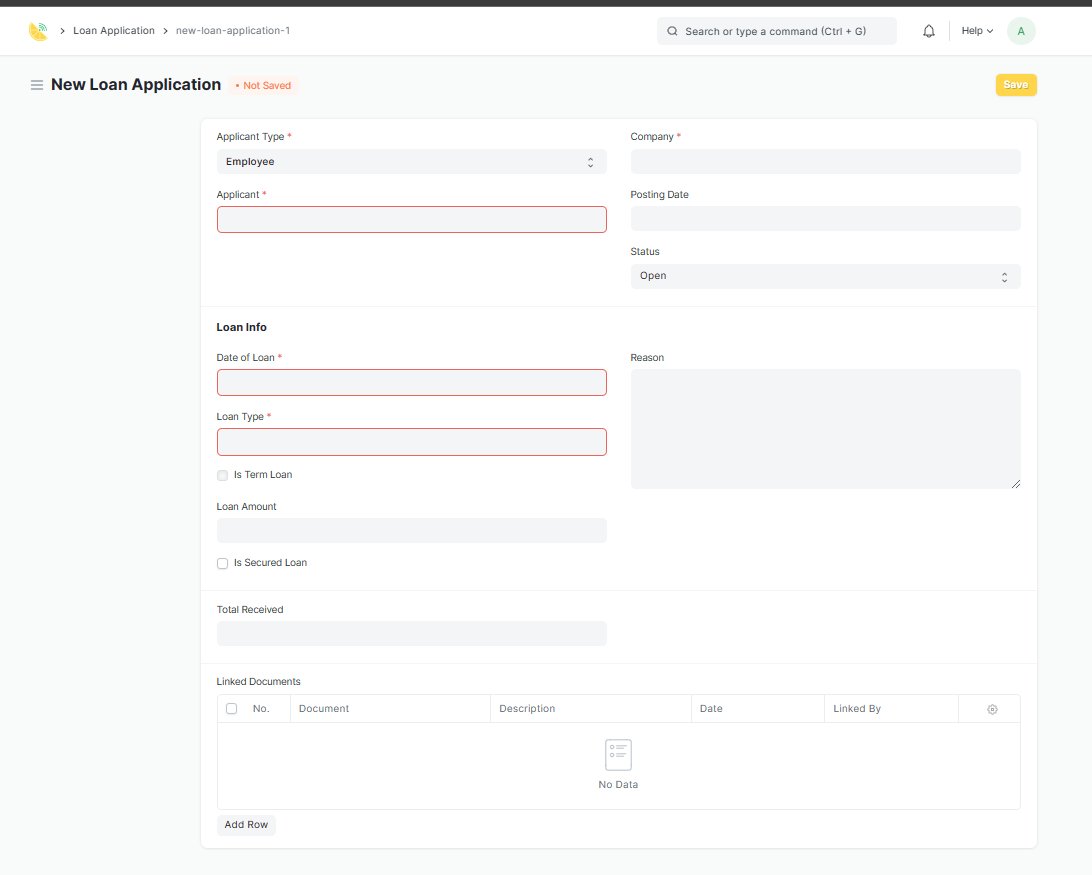

In the HR module, navigate to the "Loan" module and then select "Loan Application".

-

Click on the "Add Loan Application" button in the top right corner of the screen to create a new Loan Application.

-

In the "Applicant Type" field, select whether the applicant is an Employee or an Applicant. If the applicant is an employee, select the employee's name from the "Applicant" field. If the applicant is not an employee, enter their name in the "Applicant Name" field.

-

In the "Company" field, select the company for which the loan application is being made.

-

In the "Posting Date" field, enter the date when the loan application is being submitted.

-

In the "Status" field, select the status of the loan application, such as "Open", "Sanctioned", "Rejected".

-

"Open" - The loan application has been submitted and is awaiting a review

-

"Sanctioned" - The loan application has been approved by the HR Manager and the loan has been sanctioned.

-

"Rejected" - The loan application has been reviewed and rejected by the Approver/ HR Manager

-

-

"Loan Info" - This section contains information related to the loan being applied for, including the Date of Loan, Loan Type, Loan Amount, and whether it is a Term Loan or a Secured Loan.

-

Date of Loan- refers to the date when the loan was granted or issued to the borrower.

-

Loan Type- This refers to the type of loan being applied for, such as a personal loan, business loan, or home loan.

-

Is Term Loan- This field indicates whether the loan is a term loan, which means it is to be repaid over a fixed period of time with regular payments of principal and interest.

-

Loan Amount- This is the total amount of the loan being applied for.

-

Is Secured Loan- This field indicates whether the loan is a secured loan, which means the borrower has pledged some form of collateral to the lender as security against the loan.

-

Reason- This field allows the applicant to provide a reason for applying for the loan.

-

-

"Total Received" - This field shows the total amount received by the applicant so far, if any.

-

"Linked Documents" - This section shows any documents linked to the loan application, such as bank statements, payslips, or other relevant documents.

-

The Loan Application will now be available for review and approval by the relevant authorities.

-

Click "Save" to create the loan application.

That's it! By following these simple steps, you can create a Loan Application in Lemonade and track all the details related to the loan and its repayment.

➡ Next Step:

After 📝creating a Loan Application, you may proceed to How To ➕Add Loan.

.png?height=120&name=ServioTechnologies_logotext%20(1).png)