Loans can be categorized into different types based on their specific characteristics.

👉🏻To access Loan Type go to:

HR -> Loans Section -> Loan Types

⚙ Steps:

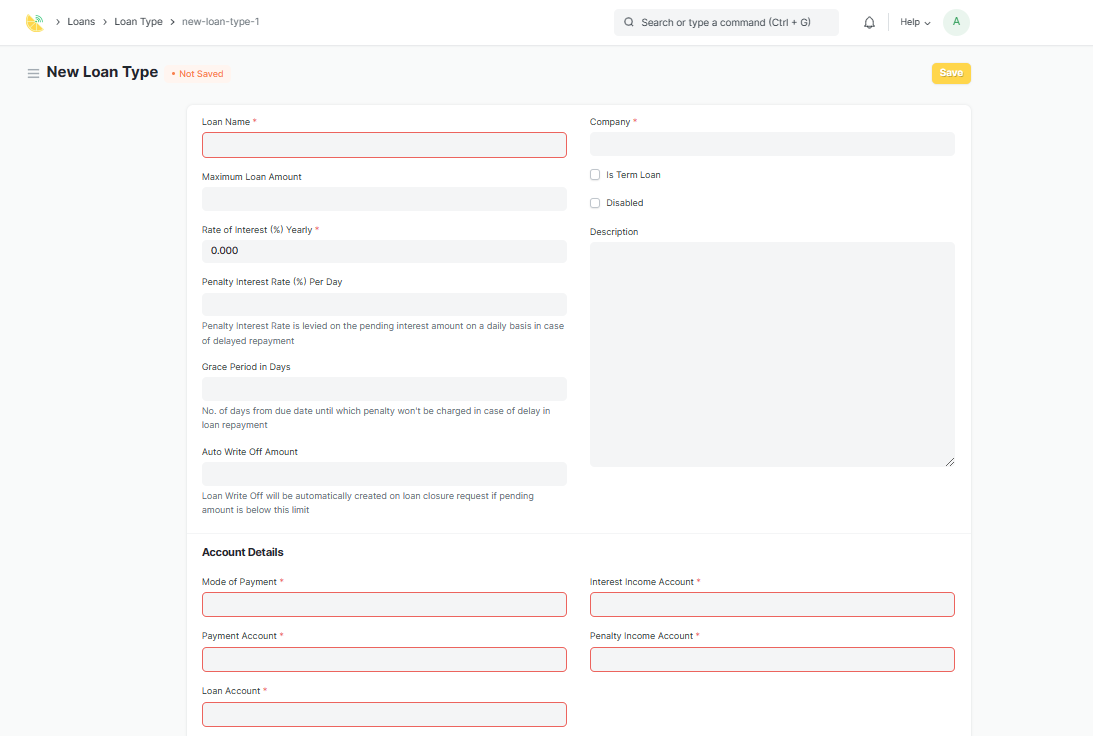

1. In HR Module. Go to 'Loan Types' then click " Add Loan Type"

2. Fill up the necessary fields such as Loan Name, Maximum Loan Amount, Rate of Interest, Penalty Interest Rate, Grace Period in Days, and Auto Write Off Amount.

- Loan Name: The name of the loan type. This field is used to identify the loan type and can be customized based on your business needs.

- Maximum Loan Amount: The maximum amount of loan that can be borrowed under this loan type. This field sets the upper limit on the loan amount that can be granted to a borrower.

- Rate of Interest (%): The annual interest rate that will be charged on the loan amount. This field determines the cost of borrowing and is usually expressed as a percentage.

- Penalty Interest Rate (%): The rate at which a penalty will be charged on the pending interest amount in case of delayed repayment. This field sets the penalty rate for delayed repayments and is usually a percentage of the pending interest amount.

- Grace Period in Days: The number of days after the due date until which no penalty interest will be charged in case of delay in loan repayment. This field sets the grace period during which no penalty interest is charged for delayed repayments.

- Auto Write Off Amount: The pending loan amount below which an automatic loan write-off will be created on loan closure request. This field sets the threshold amount below which an automatic loan write-off will be created when the borrower requests loan closure.

- Company: The company for which the loan type is created. This field specifies the company for which the loan type is created.

- Is Term Loan: A checkbox that indicates whether the loan is a term loan or not. A term loan is a loan that is repaid over a fixed period of time with a set repayment schedule.

- Disabled: A checkbox that indicates whether the loan type is active or not. When checked, the loan type will be disabled and cannot be used to create loan applications.

- Description: A brief description of the loan type. This field can be used to provide additional information about the loan type, such as its purpose or eligibility criteria.

- Account Details: The account details section contains fields for setting up the loan accounts, interest income account, penalty income account, and payment account.

- Mode of Payment: A dropdown field to select the payment mode for loan repayments. This field specifies the mode of payment for loan repayments, such as cash, check, or bank transfer.

- Payment Account: The bank or cash account from which loan payments will be made. This field specifies the bank or cash account from which loan payments will be made.

- Loan Account: The loan account in which the loan amount will be credited. This field specifies the loan account in which the loan amount will be credited.

- Interest Income Account: The account in which the interest income earned on the loan will be credited. This field specifies the account in which the interest income earned on the loan will be credited.

- Penalty Income Account: The account in which the penalty income earned on the loan will be credited. This field specifies the account in which the penalty income earned on the loan will be credited.

3. In the Account Details section, select the Mode of Payment, Payment Account, Loan Account, Interest Income Account, and Penalty Income Account.

4. Click on "Save" to create the new loan type.

➡ Next Step:

After 📝 create Loan Types , you may proceed to How To 📝Create a Loan Application

.png?height=120&name=ServioTechnologies_logotext%20(1).png)